Nike Inc (NYSE:NKE) is facing a critical juncture as it prepares to report its fourth-quarter earnings this Thursday. Investors and market analysts are turning their attention to the sporting goods giant, which is expected to post an earnings per share (EPS) of 7 cents and revenues of $12 billion. While this figure may seem promising, Nike’s stock has had a tumultuous year, reflecting a decline of 15.9% over the last 12 months and a year-to-date (YTD) drop of 11.8%. As the earnings date approaches, the question on everyone’s mind is whether Nike can ‘Just Do It’ and reverse its bearish trend.

© FNEWS.AI – Images created and owned by Fnews.AI, any use beyond the permitted scope requires written consent from Fnews.AI

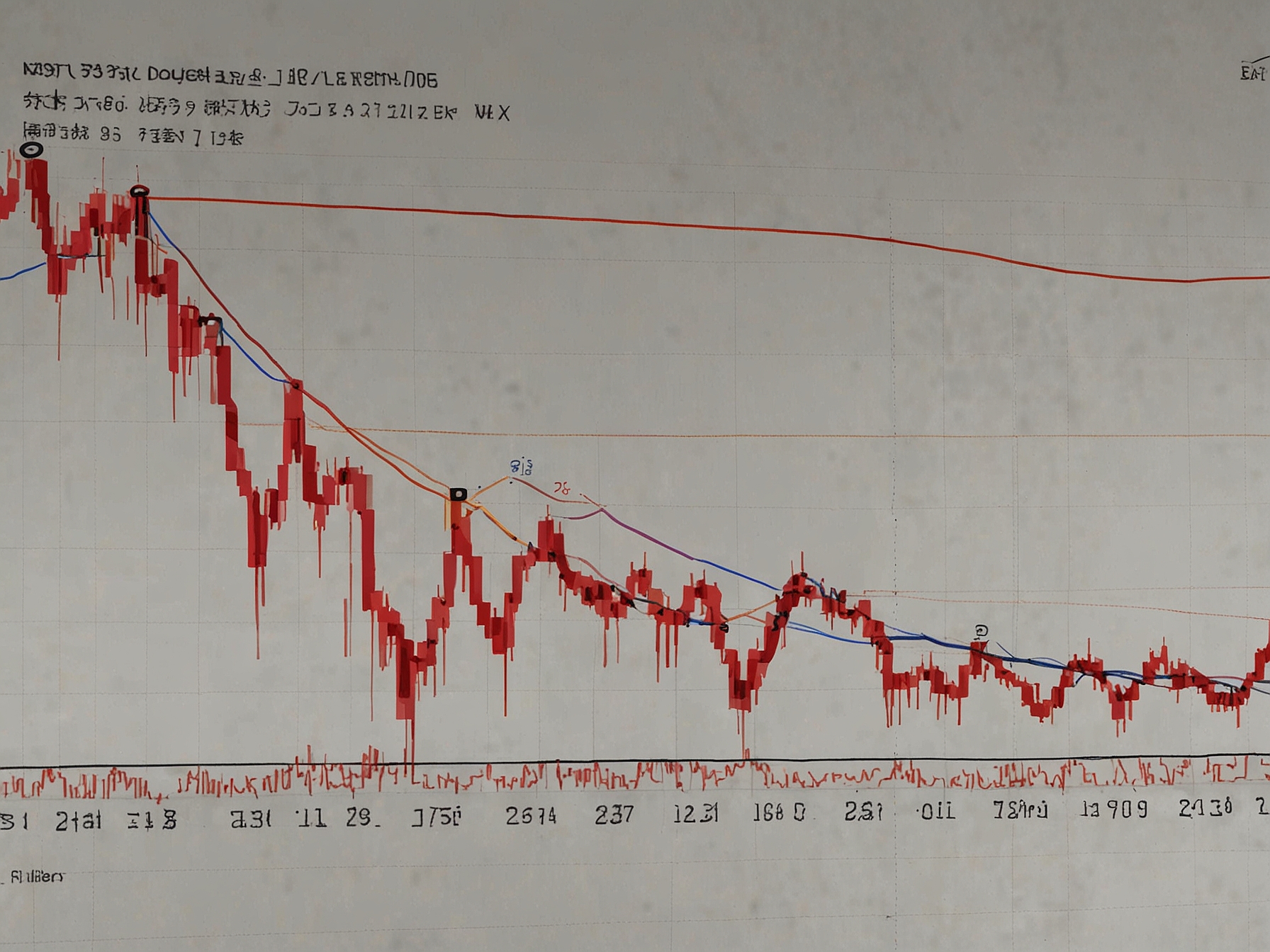

Over the past year, Nike’s stock performance has been less than stellar. The consistent underperformance raises significant concerns among investors, fueled by various macroeconomic factors, competitive pressures, and changing consumer behaviors. This bearish trend is visible in the technical setup of the stock, especially its position relative to crucial exponential moving averages. The current share price of $94.75 is trading below the 5, 20, and 50-day exponential moving averages, which are typically used by traders to identify potential reversal points and gauge the stock’s underlying momentum.

Breaking down the technical aspects further, Nike’s inability to sustain levels above these key moving averages suggests a persistent downward trend. This can be attributed to various factors, including weak consumer demand in certain markets, heightened competition from brands like Adidas and Under Armour, and supply chain issues that have plagued its operations. The moving averages act as dynamic support and resistance levels, and Nike’s positioning below them paints a grim picture for short-term bulls. Additionally, the stock’s Relative Strength Index (RSI) indicates oversold conditions, which may hint at a potential rally, albeit brief and uncertain.

© FNEWS.AI – Images created and owned by Fnews.AI, any use beyond the permitted scope requires written consent from Fnews.AI

On the fundamental analysis front, Wall Street remains cautiously optimistic. Analysts expect that Nike’s innovative product pipeline, strategic partnerships, and continuous investments in digital transformation might offer a glimmer of hope. The company has been focusing on direct-to-consumer sales and enhancing its e-commerce capabilities, which could offset some of the setbacks faced in traditional retail channels. Market participants will be keenly observing how these strategic initiatives have impacted the financial performance and what guidance the company provides for the upcoming quarters.

Financially, Nike has shown resilience in past downturns by leveraging its strong brand equity, marketing prowess, and global reach. However, this time around, the stakes are higher due to broader economic uncertainties and inflationary pressures that have affected disposable incomes and consumer spending. Any unforeseen disruptions in the supply chain or adverse changes in tariffs could further exacerbate Nike’s challenges. Therefore, the forthcoming earnings report will not only shed light on the company’s current health but also set the tone for its financial trajectory moving forward.

In the days leading to the earnings announcement, market sentiment remains mixed. On one hand, there are concerns about Nike’s ability to navigate near-term obstacles. On the other hand, there is hope that its strategic initiatives will pay dividends in the long run. Stock market experts will pay close attention to the company’s performance metrics, such as revenue growth in key regions, gross margin trends, and inventory management, which are crucial indicators of operational efficiency and strategic execution.

Beyond the quarterly earnings, investors are also eager to learn about Nike’s long-term vision. Insights into new product launches, marketing campaigns, and potential collaborations could provide a clearer picture of how the company plans to stay ahead of the competition. Additionally, any commentary on sustainability efforts and corporate social responsibility could bolster Nike’s appeal to ethical investors. With environmental concerns increasingly influencing consumer preferences, companies with strong sustainability credentials stand to benefit in retaining loyal customers and attracting new ones.

In conclusion, the upcoming fourth-quarter earnings report is a make-or-break moment for Nike stock. Although the company faces substantial headwinds, its robust brand and strategic investments in technology and direct-to-consumer channels might help mitigate some of these challenges. The company’s performance relative to Wall Street estimates will be crucial in determining investor confidence and the stock’s direction in the near term. As Nike steps up to the earnings plate, the world will be watching closely to see if it can indeed ‘Just Do It’ and overcome the bearish trend.

Was this content helpful to you?